Remy Cointreau – WTF Is Going On?

Remy Cointreau normally fly under the radar in the alcohol industry. Just about big enough to keep moving with some forward momentum, but not big enough for anyone to really give a hoot about. They have a core portfolio of 12 booze brands, not all household names, but we’ve all come across a bottle of the sweet and sickly orange stuff that makes up half of the name, and of course the cognac that makes up the other half.

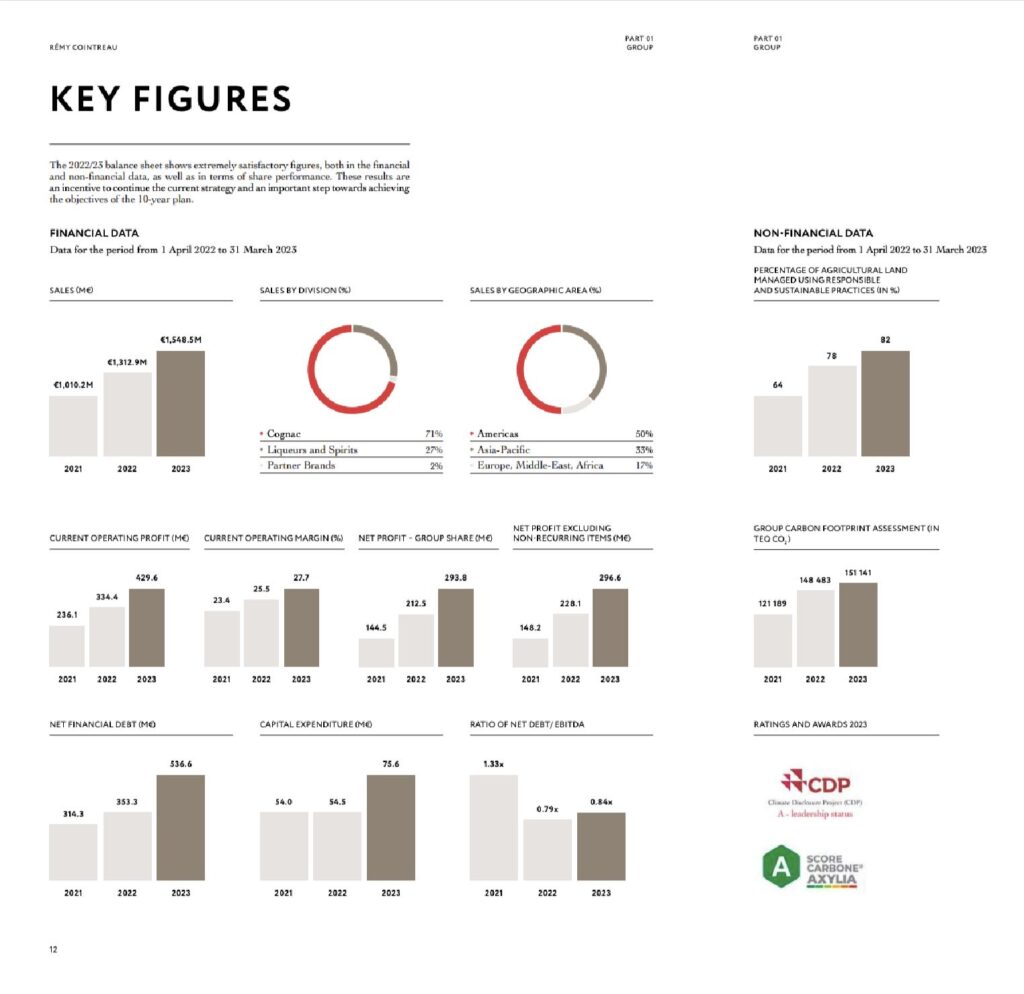

2023 was a record year for them, batting in €1.548 billion in sales, demonstrating literally a 50% increase in just two years. 2021 was €1.010 billion in turnover. Gross profits were in 2023 were €429 million, not far off double the €236 million in 2021. Profit margins sat at 27.7% (up from 23.4% in 2021) and the net profit was €293 million, up from €144.5 million back in 2021.

Remy Cointreau Share Price Chart

The numbers on the annual reports for the last three years seem to be going in the opposite direction to the share price. Hence our question, WTF is going on at Remy Cointreau?

Friday 28th June 2024, Remy Cointreau shares were trading at a 52 week low on the US markets, dropping as log as $8.15 a share,

On a 3 year chart, the stock is down 56.46%. But it’s worse than that. Taking a chart back to September 1988, when Remy Cointreau first listed, and we’re talking about a stock trading 70.56% lower than it did 36 yeas ago. It completely defies logic.

Analyst ratings on the stock are all on the downside. UBS reduced their target price on June 7th 2024, after lowering its rating on Remy Cointreau as recently as April. JP Morgan rates RemY Cointreau as a SELL, reiterating that sell rating on June 6th 2024. Barclays lowered their target price on 10th April 2024, and the only big name to rate it as a buy is Deutsche Bank.

So what’s going wrong?

Firstly, it’s the perceived over dependency on Cognac, which, in the 2023 annual report was responsible for 71% of the sales of the entire company. That’s 71% across just two products, Remy Martin and Louis XIII – with no doubt the lions share of that being on Remy Cointreau.

Add in the complexity of 50% of revenue being “The Americas” (read “the USA”) which is very much dominated by Hennessy, and the dominos start to stack up. Hennessy have a 60% market share in the USA, putting out over 4 million cases of product into the land of stars and stripes. In the on-trade, Hennessy takes up 85% of cognac sales in Union Venues and it’s probably fair to say that this is a general trend across the US. Remy Martin ranks third, with 4 brands taking up the remaining 15% of cognac sales in Union venues.

Next we have the 33% dependency on “Asia-Pacific” – which doesn’t take a genius to realise that this mostly means China. Sure, there are markets in Taiwan and Singapore and a few other key cities, but we all know, China is the future for most alcohol producers.

China is worlds largest consumer market, 1.3 billion people. It’s music to the ears of shareholders. Even when you strip off the 50% of people that don’t drink alcohol, plus the women, the children and the old folk – you still have one of the largest markets for alcohol in the world.

But when you factor in the possible anti-dumping case against French Brandy (of which cognac falls under) and a pretty limp effort at developing the market by the in country team in China, there’s no sunshine and moon beams for Remy Cointreau in the PRC. (We’ll no doubt do an article on Remy Cointreau’s disasterous adventures in China in the near future – watch out for it, it will be a great read!)

There’s also the massive debt mountain they have stacked up over the last few years. They have been lashing out bounds like fun coupons, all of which are tradable for equity in the company – which either leads to non-trivial interest payments (which eats into profits and dividends) or share dilution. Either scenario isn’t nice for a long term investor.

What Can Save Them Now

Diversification! As everyone knows, you can’t put all your eggs in one basket – and currently Remy Cointreau has got pretty much all of it in just two. Cognac and the US of A. They need to develop other markets, faster (China for sure, but not with the current team) and other products, either by in house development or by acquisition.

More whisky – an American distillery or a new world distillery would be a really smart move right now. Hanging everything on Bruichladdich is too big a gamble. Sure, they have Westland, but that’s an American Single Malt whisky and way too new a category for the US market which is dominated by bourbon.

A journey “Back to the Future” with an investment in Waterford, led by Mark Reynier – one of the people that built up Bruichladdich to sufficient scale for Remy Cointreau to buy them out back in 2012.

Alternatively, a big bumper boost in growth by a merger or acquisition of another stable of brands. Campari would be too big (in fact, rumors are that Campari have been sniffing out a way to just swallow Remy Cointreau whole) but something like Camus could be a useful and strategic decision. Despite Camus being a tiddler, they have an amazing footprint in the China market, and put Remy Cointreau to shame. Putting Cyril Camus in the big seat to lead China, on a merged Remy Cointreau Camus would be the smartest move at the least cost.

No thanks needed Eric – you’re welcome to our free advice.

For more news about Remy Cointreau CLICK HERE.